how much does nc tax your paycheck

Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. North Carolina Income Tax Calculator 2021.

Paycheck Calculator Take Home Pay Calculator

Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent.

. OSC Training Center 3514 Bush Street Raleigh NC 27609. Just enter the wages tax withholdings and other information required. What percentage of tax is taken out of my paycheck in Colorado.

Compare State Tax Brackets Rates For. No state-level payroll tax. Federal unemployment taxes are calculated at the 6 rate for the first 7000 of the employees annual salary.

In 2013 the North Carolina Tax. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. How Much Does Nc Tax Your Paycheck.

Hourly non-exempt employees must be paid time and a. Our calculator has recently been updated to include both the latest Federal. If youre one of the lucky few to earn enough to fall into the 37.

North Carolina has not always had a flat income tax rate though. The income tax is a flat rate of 499. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes.

Your employee should provide you with an Employees Withholding Allowance. The current rate for Medicare is 145. Start filing your tax return now.

For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. How much is payroll tax usually. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

The median household income is 52752 2017. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

As of 2020 only 14 states dont tax pensions. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. Your average tax rate is 1198 and your.

For example in the tax. North Carolina Gas Tax. For tax years 2015 and 2016 the north carolina individual income tax rate is 575 00575.

Any wages above 147000 are exempt from. For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Minimum Wage in North Carolina in 2021. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. This tax can be reduced up to 54 by paying the North Carolina state.

Skip to main content.

How To Decipher Your First Paycheck Capital Asset Management Inc

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

25 Great Pay Stub Paycheck Stub Templates Words Book Report Templates Education And Literacy

Paycheck Calculator Take Home Pay Calculator

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

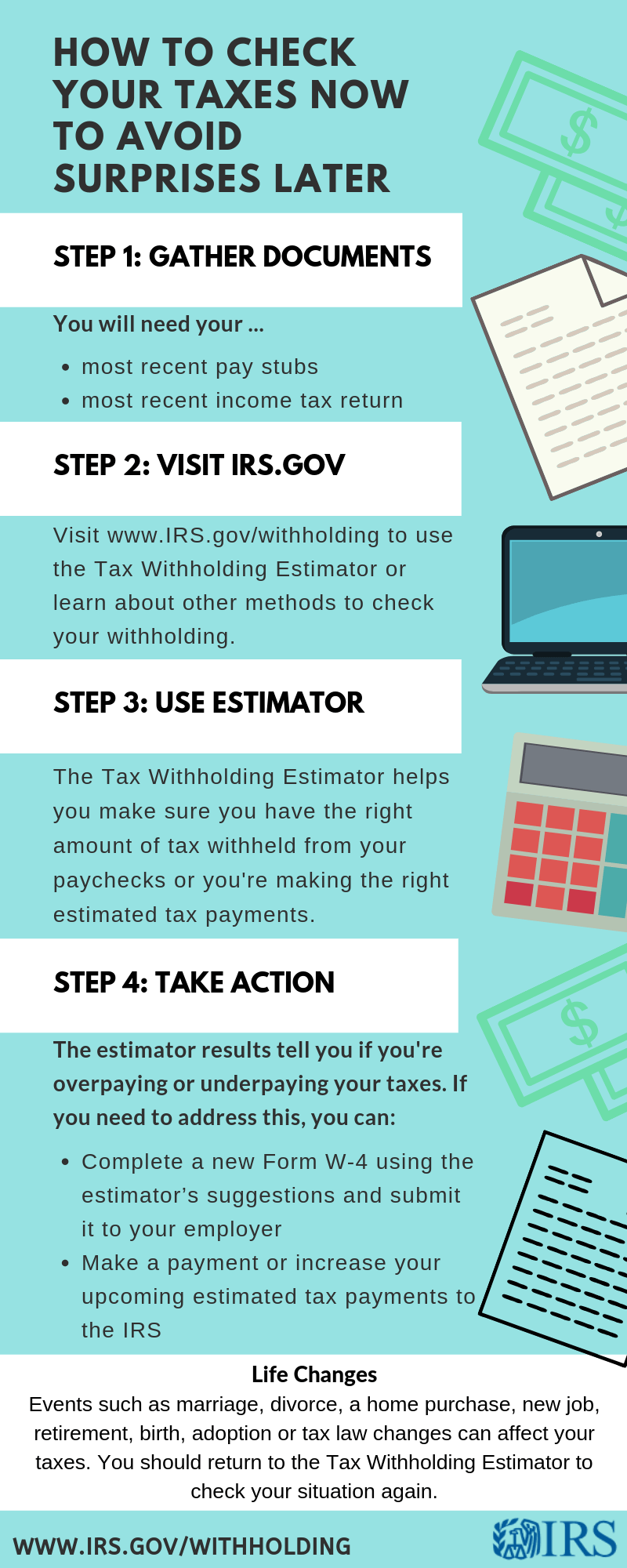

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

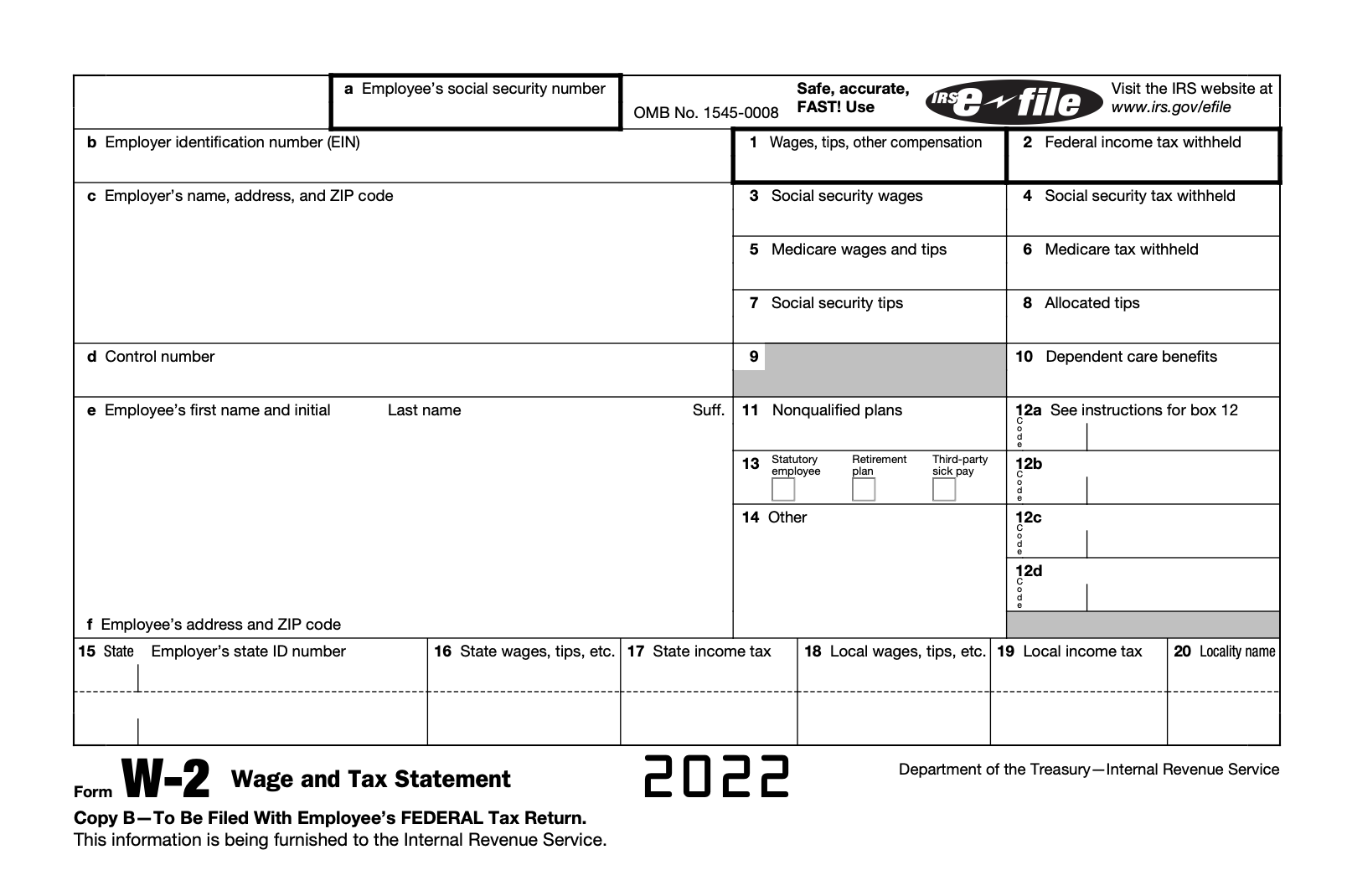

Understanding Your W 2 Controller S Office

Form W 2 Explained William Mary

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Understanding Yourself Teaching Activities

How To Organize Tax Records Blog Organization Organization Professional Organizer

North Carolina Paycheck Calculator Smartasset

Tax Information Career Training Usa Interexchange

![]()

North Carolina Paycheck Calculator 2022 With Income Tax Brackets Investomatica